LIFE Newsletter August 2023

We’re excited for what’s ahead

This year it is important to us to shift to producing content that we resonate with. One of the biggest changes for our Life Newsletter will be highlighting organizations that we will be supporting this year. Each charity we highlight will receive a $500 donation from Abound Financial.

We’re excited to share more about the causes that we’re passionate about and hope they inspire you as much as they inspire us.

Life Lessons

“Whoever trusts in his riches will fall, but the righteous will flourish like a green leaf.”

Proverbs 11:28 ESV

Investment Updates

-

The STAAC maintains its recommended neutral equities allocation based on the Committee’s assessment that the risk-reward trade-off between equities and fixed income is roughly balanced now that stock valuations are approaching a price-to-earnings ratio of 20, based on the S&P 500 Index, and fixed income offers the most attractive yields in decades.

-

The Committee favors large cap stocks over their smaller brethren ahead of a likely economic slowdown in the second half.

-

Style views remain neutral overall. Our technical analysis work points toward growth but valuations support value.

-

The STAAC’s regional preference remains developed international stocks over the U.S. and emerging markets (EM) due mostly to valuations, the potential for a weaker U.S. dollar, and more shareholder friendly management teams in Japan.

-

If the Fed is finished raising rates in July, then we could soon start to see lower yields on intermediate-term fixed income securities. Our year-end 2023 target for the 10-year Treasury yield is 3.25% to 3.75%.

-

The selloff in the banking sector has provided an attractive opportunity in preferred securities, however the risk/reward for core bond sectors (U.S. Treasury, Agency mortgage-backed securities (MBS), investment-grade corporates) is more attractive than plus sectors, in our view.

This research material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

Faith in Action

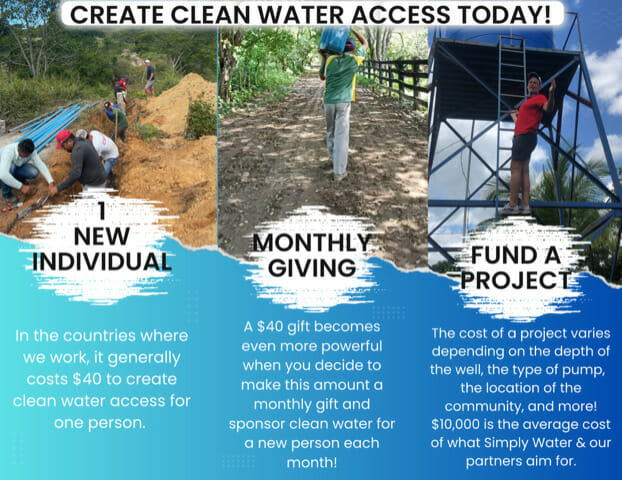

This month we would like to introduce Todd Thakar, Chief Executive Officer of Simply Water.

Todd’s family is pictured at his wedding to Angie.

Angie and I want our marriage and our lives to be centered on saying “yes” to whatever God puts on our hearts. Fortunately, we have lived enough life and weathered plenty of storms to no longer need to understand the ask, we just need to know it’s from God.

We met when a college student I was mentoring took an interest in Angie’s daughter. Angie, mom to two sons and twin daughters, had been widowed about 5 years. I am the dad to four grown daughters and had been divorced about 10 years. On our first date, we had an intuitive insight to each other – agreeing that we would not have chosen our trials, but that we loved how God had grown us through them.

Although we knew quickly our relationship was special, God challenged us to pursue each other in a way that worked for our children too. As you can see, we had 8 happy kids and a glowing bride and groom. Oh, and the college student is now my son-in-law.

We started Simply Water to chase the God-sized dream of empowering 10 million people- yep that’s million- to change the world. Angie and I celebrated New Year’s 2020 in Nicaragua, helping to bring clean water access to overlooked communities. We met an elementary school principal who clutched her chest as she told us her “dream” to have one hour a day of running water at a spigot near her front door. Our hearts were forever touched.

We have stepped out of the boat with Simply Water and love seeing God continuing to show his hand. We launched in earnest last November, and more than 725 people have either donated or participated in our “costless giving campaign” that together have raised nearly $60,000 and brought sustainable clean water access to three forgotten communities in Nicaragua. We see our marriage as a mission and want Simply Water to help all people realize that, regardless of their vocation, God has a mission for them that will matter 10,000 years from now.

If you would like more information or are feeling inclined to give to this cause you can find more information here:

Economic Update

Making economic forecasts and stock market predictions can be humbling. It’s especially tough when you expect stocks to go higher and get a big drop instead. The environment today is the opposite, but still tricky, as recession hasn’t followed the chorus of predictions. In some ways, figuring out what to do now that stocks have gone up is as difficult as considering what to do when stocks are down.

Today’s more fully valued stock market is pricing in an increasingly optimistic outlook for economic growth and corporate profits, but the economy still faces challenges that will likely lead to slower growth in the second half — and perhaps even a mild economic contraction. So why stay invested?

First, it’s difficult to time the market. We’ve seen this play out several times in just the past few years. For example, few foresaw the strong market rebound that occurred as we came out of lockdown in 2020, or that inflation would become the ongoing problem that we’re still dealing with today. We saw it again this past spring – professional portfolio managers and investors alike were broadly pessimistic about the stock market, particularly in the wake of several bank failures. Yet, stocks have gone virtually straight up since.

Another reason to stay invested is recent and encouraging economic data, which supports higher stock prices as the odds that the U.S. economy achieves a soft landing have increased. The U.S. economy grew 2.4% in the second quarter, a solid pace for a typical economic expansion these days. The job market remains healthy with near record-low unemployment. A resilient economy has fueled better profits for corporate America than most expected, setting up a likely end to the ongoing earnings recession in the current quarter.

Third, lower inflation may continue to support stocks in the months ahead as the Federal Reserve (Fed) winds down its interest rate hiking campaign. The Fed’s preferred inflation measure (the core PCE deflator) dropped a half point in June to 4.1% and could potentially reach the mid-3s by year-end — not far from the central bank’s 2% target. Lower inflation may also be good news for bonds by enabling the Fed to cut interest rates in 2024 as most expect.

Fourth is historical comparisons. Since 1950, stocks have gained an average of 40% one year following bear market lows. Nearly 10 months since our bear market low, our current bull market is up about 28% so far. Keep in mind, once the S&P 500 has gained 20% off a bear market low (which it did June 8, 2023), the one-year average historical gain is 18.9%. We’re also in the best year for stocks within the four-year presidential cycle. In other words, more gains, and record highs, in the coming year are reasonable to expect.

Finally, for those worried that gains in the broad market have been driven by only a handful of stocks, stock market leadership has started to broaden out. We believe that’s a necessary condition for the next leg of this bull market. Small cap stocks fared better than large caps in July and the average stock in the S&P 500 rose more than the index over the past two months.

For those who may have missed the rally, we would advocate for dollar cost averaging which is simply investing at regular intervals over a period of time. This can be a great approach as it takes emotion off the table. Consider maintaining a cash reserve so you can take advantage of dips that will inevitably come and use volatility as an opportunity to get back to long-term target allocations.

Please reach out to me if you have any questions.

Sincerely,

David Laut

CEO, Certified Financial Planner™

O / 916-846-7780

A / 4180 Douglas Blvd. Suite 200, Granite Bay, CA 95746

Important Information

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

All data is provided as of June 6, 2023.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All index data from FactSet.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

This Research material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Past performance does not guarantee future results.

Asset allocation does not ensure a profit or protect against a loss.

For a list of descriptions of the indexes and economic terms referenced, please visit our website at

lplresearch.com/definitions.