LIFE Newsletter June 2023

We’re excited for what’s ahead

This year it is important to us to shift to producing content that we resonate with. One of the biggest changes for our Life Newsletter will be highlighting organizations that we will be supporting this year. Each charity we highlight will receive a $500 donation from Abound Financial.

We’re excited to share more about the causes that we’re passionate about and hope they inspire you as much as they inspire us.

Life Lessons

“Whoever has a bountiful eye will be blessed, for he shares his bread with the poor.”

Proverbs 22:9 ESV

Investment Updates

-

The STAAC lowered its recommended equities allocation to neutral based on a less attractive risk-reward trade-off relative to fixed income. Increasing odds of a recession and less attractive equity valuations relative to fixed income temper enthusiasm.

-

The Committee favors large cap stocks over their smaller brethren. Style views remain neutral overall, though our technical analysis work leans toward growth. The STAAC’s regional preference remains developed international stocks over the U.S.

-

The Fed’s determination to keep rates higher for longer caused U.S. Treasury yields to move significantly higher in 2022. Our year-end 2023 target for the 10-year Treasury yield is 3.25% to 3.75%.

-

The selloff in the banking sector has provided an attractive opportunity in preferred securities, however the risk/reward for core bond sectors (U.S. Treasury, Agency mortgage-backed securities (MBS), investment-grade corporates) is more attractive than plus sectors, in our view.

This research material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

Faith in Action

This month we would like to introduce Julie Morales-Harrold, Chief Operation Officer of Agape International Missions.

Julie’s family pictured above left to right: her daughter Erin, Julie, her son Ryan, and her husband Ray

After moving from Texas to the Sacramento area in 2001, Julie Morales-Harrold began a new career in ministry and had no idea what God had in store for her. In 2010 she cautiously said “yes” to leading a short term missions team to Cambodia to serve with an anti-trafficking ministry called Agape International Missions (AIM). This trip was life changing. It was during a tour of AIM’s Restoration Home (ARH) when Julie’s heart was broken. ARH is a place where young girls who are rescued from sex trafficking live while they begin their healing process. Here they receive counseling, education, and lots of love from the staff. During this tour, a little girl took Julie’s hand as they walked upstairs. It struck her that this little girls’ hand was tiny, her body was tiny, and she was there because she had been rescued from being trafficked. After returning home to Sacramento, she could not forget this little girl and began praying – asking God what she should do next. Her heart was broken and she needed to do something about this terrible issue of sex trafficking. After praying for over a year, God answered and provided a job at AIM. She has been with AIM for 11 years and now serves as their Chief Operation Officer. She says she found her “why” when God broke her heart during that short term missions trip.

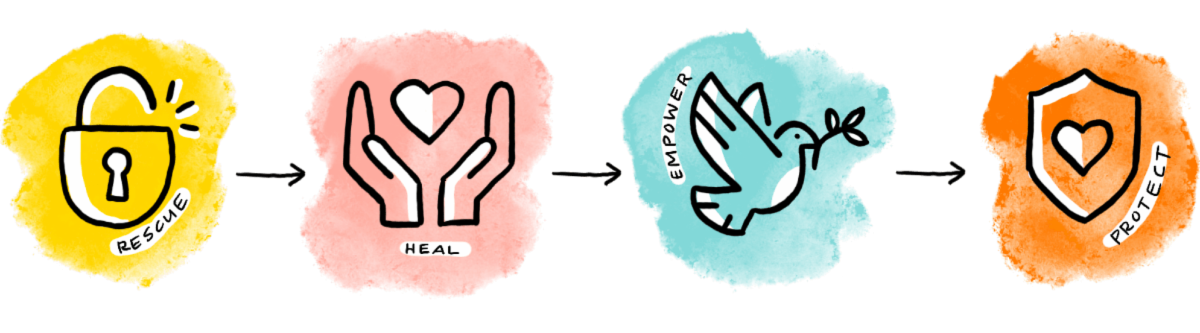

Agape International Missions (AIM) exists to glorify God through dedicated efforts to love, protect, and care for survivors of trafficking as well as other vulnerable and exploited individuals. Through a holistic approach of rescuing, healing and empower survivors of trafficking and protecting the vulnerable, AIM seeks to meet survivors’ spiritual, emotional, social, educational, and physical needs. Our intention is that they may come to know their worth and value in Christ, develop, a dependence on Him, and develop skills for a sustainable life of freedom!

College Golf Fellowship exists to make disciples by investing relationally with the Gospel of Jesus Christ throughout the world of college golf.

AIM has a 4 part rehabilitation program to rescue, restore, and reintegrate survivors of sex trafficking through Christ’s love and Gospel.

If you would like more information or are feeling inclined to give to this cause you can find more information here:

Economic Update

Every so often Washington likes to remind us how hard it can be to get things accomplished. The most recent example is the debt ceiling—the amount Congress can borrow to pay its bills. It seems like we have this debate every few years and in the end a deal is made, which is just what happened this time. Considering equity markets never really reacted to the drama, perhaps this is a good reminder that focusing on long-term objectives is the best strategy, even amid a fair amount of market noise.

With the debt ceiling drama behind us, markets will likely return their attention to topics such as inflation, the health of the economy, and the Federal Reserve (Fed)—who is scheduled to meet June 14-15. Expectations are that they will not raise short-term interest rates for the first time in 10 meetings. The Fed has done a lot of heavy lifting already—raising short-term interest rates by 5% in just over a year. Since rate hikes tend to have a long and variable lag, the Fed wants to see how those rate hikes more fully flow through the economy before its next move.

The Fed’s goal has been to elevate the fed funds rate and make the cost of borrowing money prohibitively expensive, to slow aggregate demand. While this has exposed some cracks in the regional banking sector, it should allow inflationary pressures to abate. But then what? After winning its fight with inflation, the Fed is expected to start cutting rates early next year. Just as the aggressive rate-hiking cycle took Treasury yields higher, interest rate cuts will take Treasury (and other bond market) yields lower. Both lower inflation and an end to rate increases could be welcome news for core bonds, especially intermediate core bonds, which have tended to perform well after rate-hiking campaigns. Investors may be better served by locking in these higher yields before they’re gone.

Only time will tell, but it feels like we’re finally on a path to lower interest rates and the end of this inflationary cycle. Of course there will be other challenges to deal with, that’s just the dynamic nature of the market. But in the meantime, returning to the familiar—lower rates and the end of inflation—is something we can all rally around.

Please reach out to me if you have any questions.

Sincerely,

David Laut

CEO, Certified Financial Planner™

O / 916-846-7780

A / 4180 Douglas Blvd. Suite 200, Granite Bay, CA 95746

Important Information

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

All data is provided as of June 6, 2023.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All index data from FactSet.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

This Research material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Past performance does not guarantee future results.

Asset allocation does not ensure a profit or protect against a loss.

For a list of descriptions of the indexes and economic terms referenced, please visit our website at

lplresearch.com/definitions.